Moroku Money & Mambu: A Game-Changing Integration for Challenger and Community Banks

As the financial landscape evolves, banks are adapting to meet the demands of digital-first customers. For large banks with billion-dollar budgets, their challenge is agility. For others, it is balancing desire with economics. That’s why Moroku and Mambu have collaborated to integrate Moroku’s digital channels with Mambu’s leading cloud-native core banking platform. This partnership delivers a powerful combination of contemporary digital banking with agile core banking, offering challenger and community banks in Australia and New Zealand a compelling, economic alternative, with over 50% savings on current operating models with significant, composable, service improvements.

Breaking Down the Integration

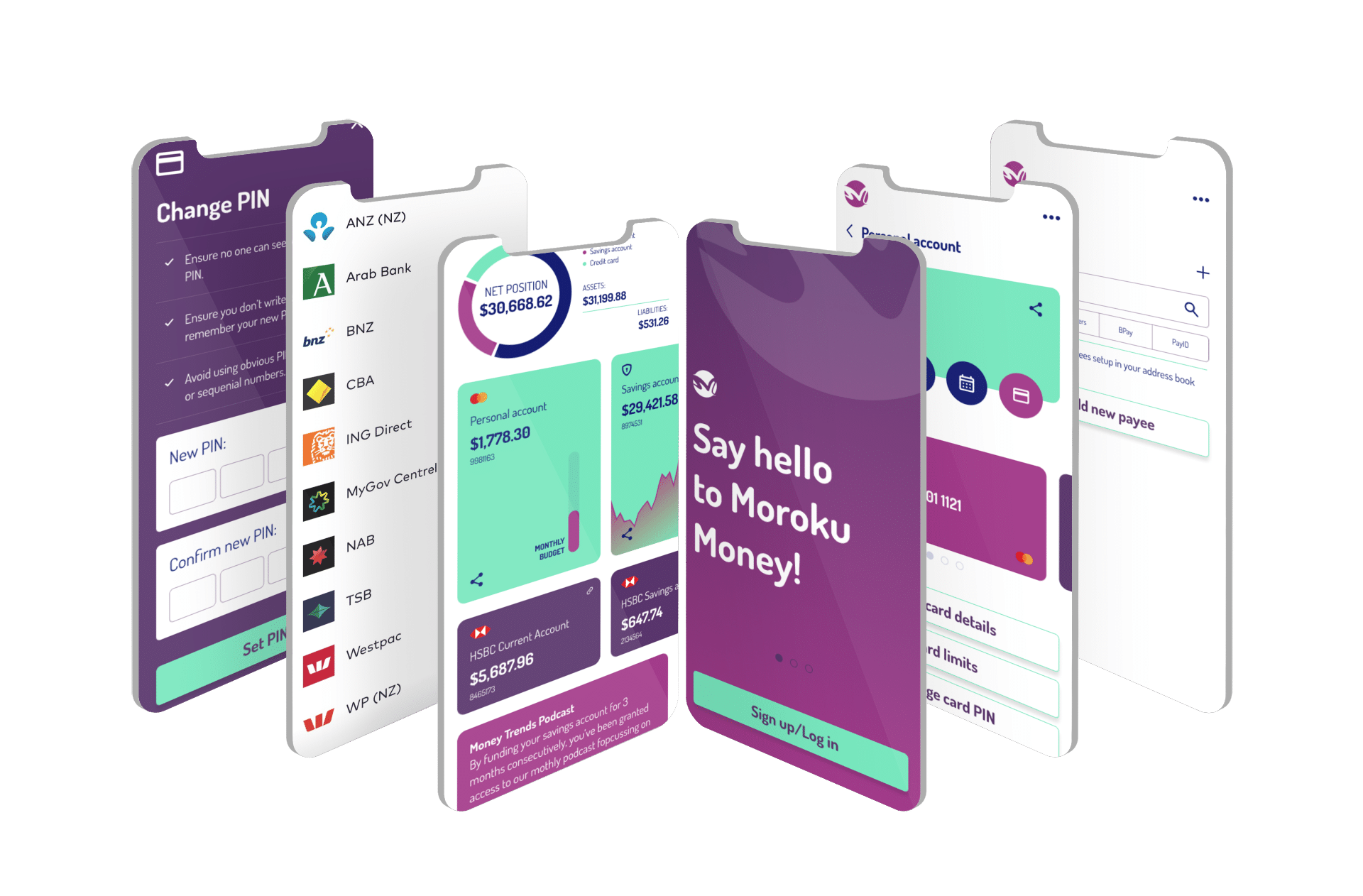

Moroku Money: Data Driven Banking for Customer Engagement

Moroku Money is a white label digital banking solution, designed to transform banking into an engaging experience. By applying contemporary software and data architectures with game mechanics, behavioural science, and AI-driven insights across mobile banking, internet banking and loan origination, Moroku Money helps banks:

✅ Boost customer engagement through interactive financial journeys

✅ Encourage better financial habits with rewards and nudges

✅ Increase growth and retention by making banking more rewarding

Mambu: The Agile Core Banking Platform

Mambu provides a flexible, cloud-native core banking system that enables banks to:

✅ Launch new financial products quickly without legacy constraints

✅ Scale efficiently with modular architecture

✅ Integrate seamlessly with fintech solutions

The Joint Value Proposition

By integrating Moroku Money with Mambu, banks can:

🚀 Deliver hyper-personalised banking experiences that drive engagement

🔄 Combine gamification with agile banking for a future-proof strategy

💡 Offer challenger banks a competitive edge in customer acquisition and retention

A Compelling Choice for Australian & New Zealand Banks

Many financial institutions are re-evaluating their technology stack as legacy stacks and providers fall behind. The Moroku-Mambu integration presents a clear alternative for banks seeking:

✔ Choice via composable architectures

✔ Customer-centric banking experiences

✔ A modern, cloud-native approach

This partnership is not just about technology—it’s about redefining banking. Challenger and community banks now have the tools to engage customers, scale efficiently, and compete effectively in a digital-first world.

Ready to Elevate Your Banking Experience?

Learn more about how Moroku Money & Mambu can transform your financial institution: