Moroku construed Odyssey in 2016 when it foresaw the increasing commoditisation of banking forcing banks to get closer to customers as engagement became the new battleground. Eight years on, banks are beginning to agree. Whilst convenience was a unique value proposition for internet banking in 1997, this is no longer the case. Forced to compete on engagement or price, banks would prefer to compete on value and margin creation.

Moroku Odyssey is an orchestration and engagement platform for digital banks.

As a SaaS platform, Moroku Odyssey integrates securely into the digital infrastructure to convert data, into engagement, emotion and loyalty.

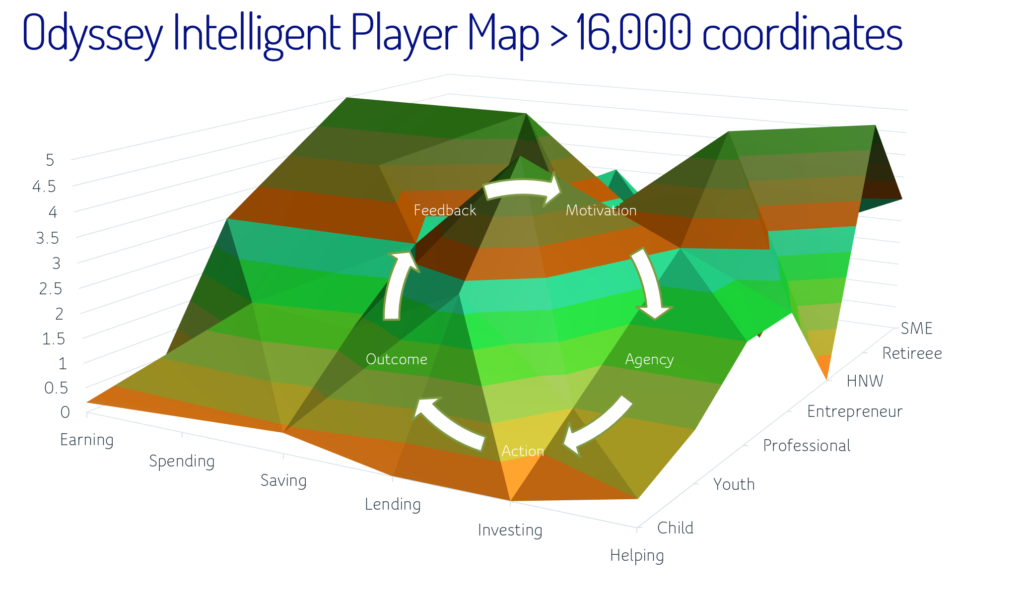

Moroku Odyssey connects to transaction and data platforms to recognise customer efforts, reward their success and support them through their money challenges in real time through the digital experience. Unlike other personalisation, loyalty and engagement systems, Moroku Odyssey, combines game theory, data and AI to create emotional intelligence and connection. The platform is available as a set of APIs along with a design process to define the initial set of player journeys prior to AI and ML hyper personalising those journeys