Digital Loan Origination

Loan transformation is a critical priority for retail digital banks wanting to:

- Streamline origination

- Increase conversion rates

- Fortify compliance

- Create a modern sales culture.

- Make loan contracting accurate

Need The Details

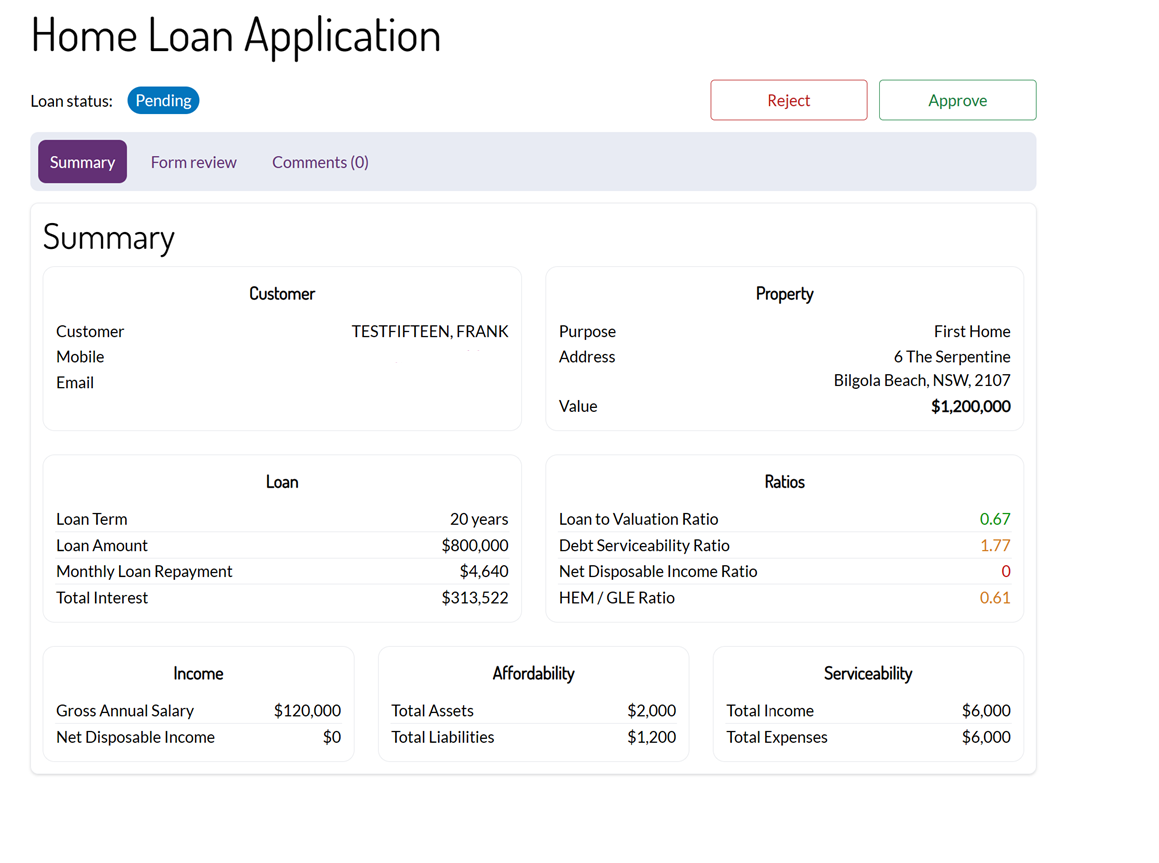

Increase speed to decision

Conversion rates can be increased by improving loan decisioning speed. Ditch the spreadsheets and get the data to your loan decisioning team fast and in a format that allows them to run lean, with speed.

Moroku Money, Lending, is a cloud based, loan originiation platform for loan servicing. With audit trails, document management, contract generation and both customer and loan officer modules, the platform provides a real time loan origination solution for credit unions, banks and lenders looking for the most contemporary software solutions to compete for customers and staff.

Focus on the pinch point

Operations 101

Operations 101 in any manufacturing process is oriented around identifying pinch points and removing them. Pinch points are anywhere you have a build-up of inputs or rework. Any improvement other than at the pinch pint is an illusion, i.e. not an improvement. Often times in lending these pinch points are not at settement into the system, but further upstream within the customer and staff experience, i.e. getting the data and making decisions.

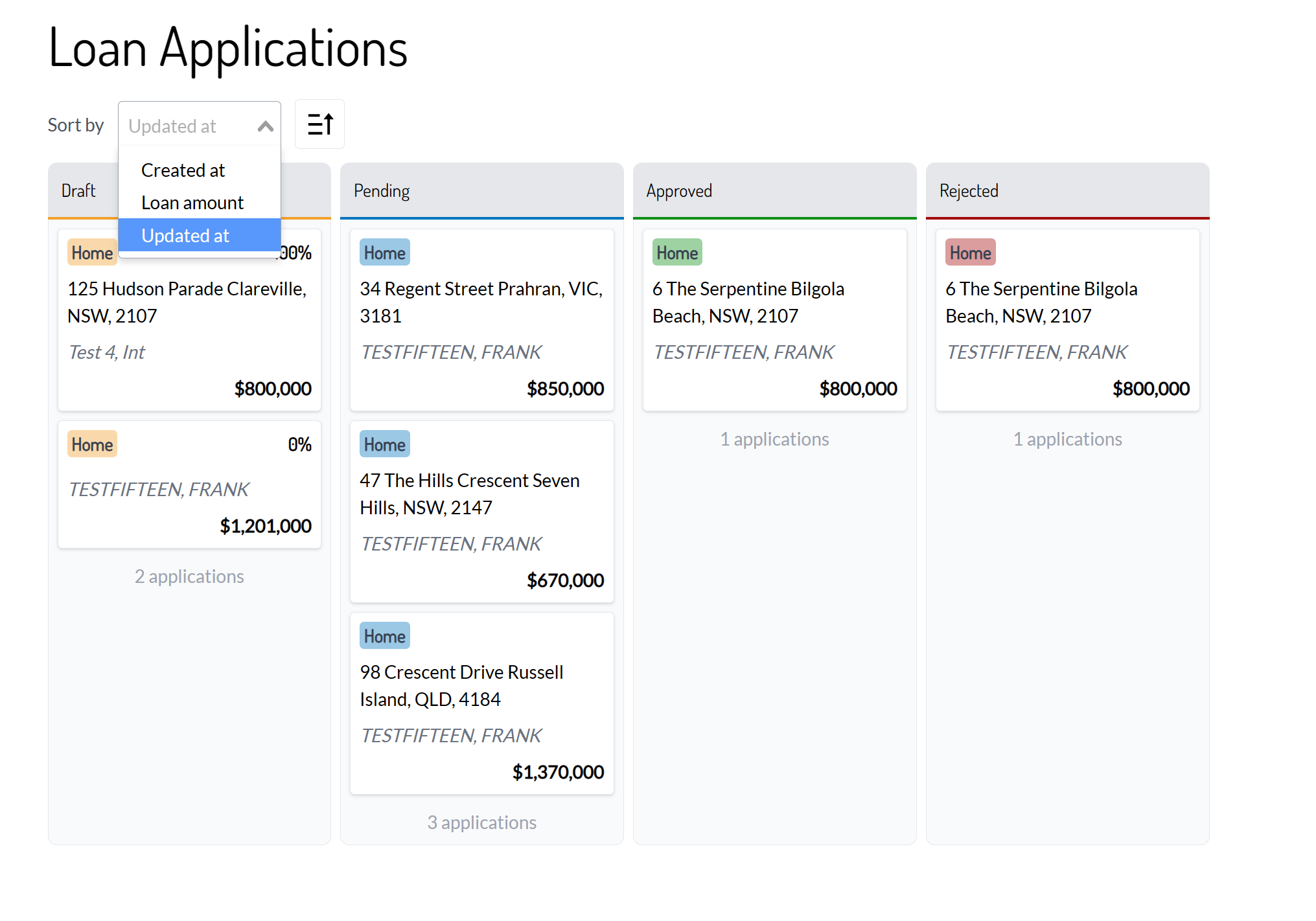

Funnel Management

Implement agile sales management to see what loans are where in the sales cycle and build a sales team culture with Kanban boards. Through the loan officer portal, you can quickly see all loans in the funnel, click on them, review the application, follow up, approve or reject then fund. An agile business!

A contemporary lending experience.

Pre and Post Sales

Whilst you work on the back end , make sure the customer experience is top notch.

Whilst large banks dominate the landscape of money, changing competition and advanced automation continue to squeeze the margin between deposits and lending unless margin can be found in the provision of additional sources of value or obscurity.

With so much talk about recession, inflation and cost of living pressure, customers are increasingly bamboozled by choice and noise. Customers are responding by turning to mortgage brokers and exiting digital channels.

Opportunity exists by targetting existing and niche customers as a trusted advisor combined with product leadership; helping customers understand their money with great customer experience.

Moroku Money Lending addresses this challenge across the presales and post sales journey with a great loan application experience, that can operate standalone, integrated within digital channels or other loan origination systems.

Contemporary Web Services

The power of game design. The speed of open banking.

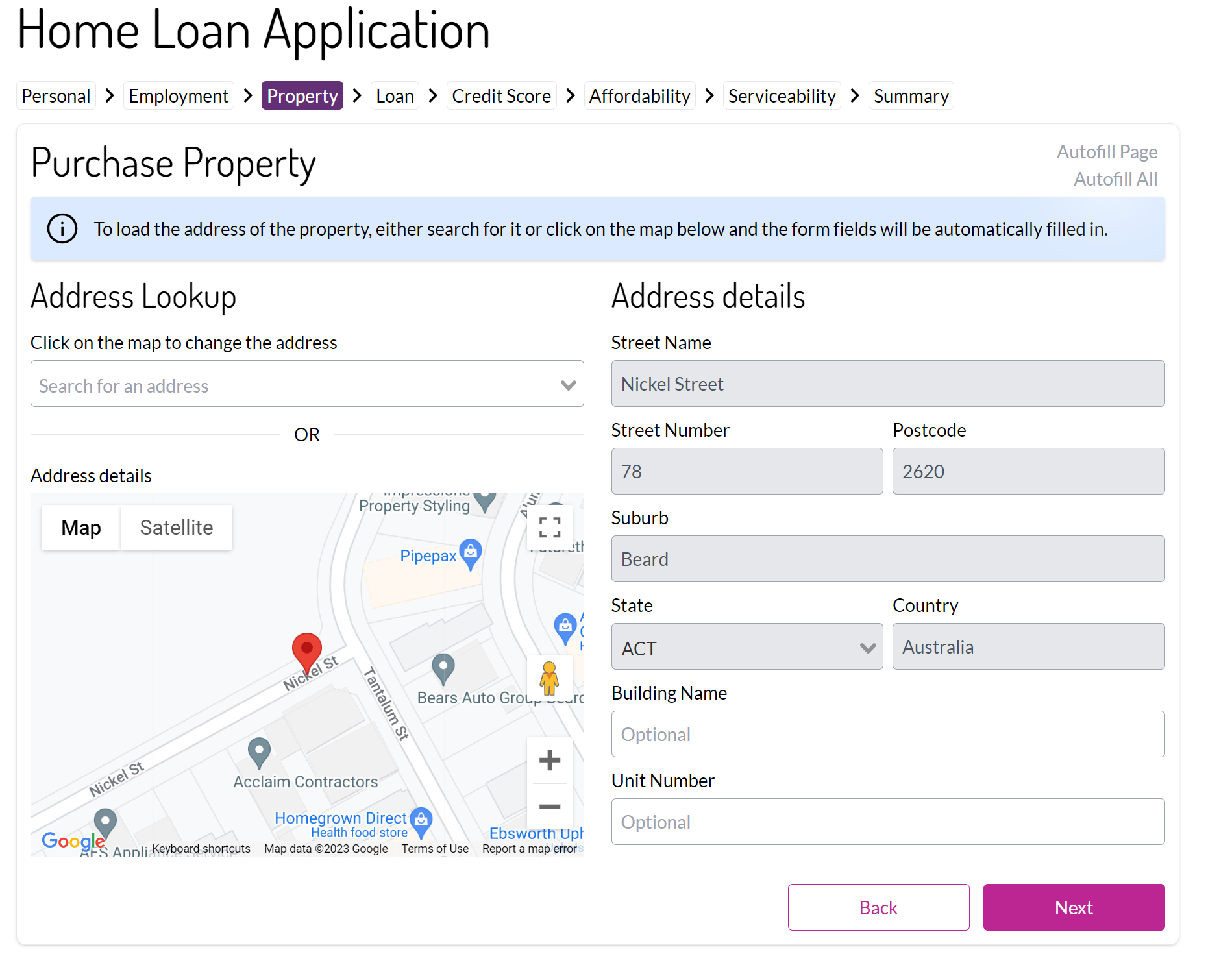

Google Map Look Ups, Basiq Open Banking, HMEs and Credit Score calculations and looks ups , all included

Banks, Fintechs and Credit Unions use Moroku to deliver what others can't.

Trusted Advisor

Offering services that deepen the relationship and increase loyalty.

Product Leadership

Differentiate through innovative products for which they can command premium prices, being valued for the quality, including timeliness, of their products.

Customer First

Using game design, set the customer up for success.

Digital Onboarding

Uploading identity documents and creating new customers.

Fast Applications

Open Banking to access customer’s data at other financial institutions, then run it through the analytics engine to improve and speed decisioning.

Funnel Management

Kanban boards to see what loans are where in the funnel.

Modern Loan Contracting

Generate loans automatically to speed closure and improve accuracy. Real money can be lost by getting rates and other terms wrong through manual processes. Digitise loan contracting to improve speed, accuracy and scalability.

Improved Data Quality

Property search and field validation to improve data quality and provide richer, more timely, experiences.

Built by delivering to some of the world's most ambitious customers.

Moroku has been working with some of the world’s leading fintech and banking brands to discover how game thinking can empower the next generation of banking experiences that take customers on a journey with their money. With Moroku Money, this has now been democratised.

Get in touch today

Let us know whow we can help.