As discussed previously, hyper-personalization overlays customer information within a set of data models to establish and then increasingly personalise digital customer profiles to offer individualized services that cater to the users’ changing needs.

Hyper-personalized services are proactive, embedding hypotheses on where customers are going, based on where they’ve come from, where they are, behavioural analysis around the direction they are heading and any course correction or support they may need or be looking for to get there.

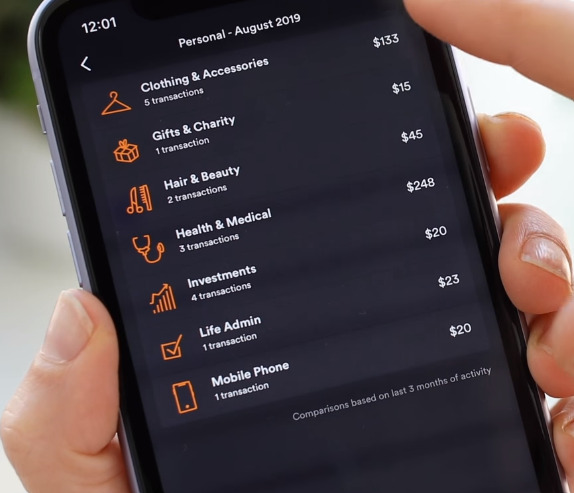

On the spending mission, most of today’s efforts are tactical in so far as they categorise transactions based on merchant codes into a large number of buckets.

Here you can see a standard tactical example from Aussie digital bank Up with a promise to help users understand their spending habits with auto-spend categorisation, weekly reports and insights into how much is spent at different brands and shops.

There are a number of fundamental flaws with this model that break user experience and engagement rules.

The first is that there is no call to action. What is the user meant to do with this information?

The second is that it ignores the principle of flow. Mihály Csíkszentmihályi was the head of psychology at the University of Chicago and is most well known for his work on “The Flow”. Csíkszentmihály unpacks what it takes to be fully engaged and delineates tactical personalisation efforts from strategic; a moment in time (tactical) versus some reflection of the past connected to a vision for the future (strategic), measuring and recognising and supporting effort over time, space and motion.

The third is that it fails the choice paradox. The Paradox of Choice – Why More Is Less is a book written by American psychologist Barry Schwartz and first published in 2004. In the book, Schwartz argues that eliminating consumer choices can greatly reduce anxiety for consumers.

Schwartz argues that the dramatic explosion in choice, from the mundane to the profound challenges of balancing career, family, and individual needs, has paradoxically become a problem instead of a solution and how our obsession with choice encourages us to seek that which makes us feel worse as we become overwhelmed.

Schwartz suggests that offering too much choice may result in 3 negative side effects:

1. Analysis Paralysis: When there are too many options, customers will become paralysed and instead do nothing.

2. Buyers’ remorse: After finally making a decision, customers experience a sudden pang of guilt, second-guessing whether they’ve made the right choice.

3. Decision fatigue: We each have the energy to make a finite number of decisions each day. Once we’ve reached that limit, our ability to make more is severely impacted.

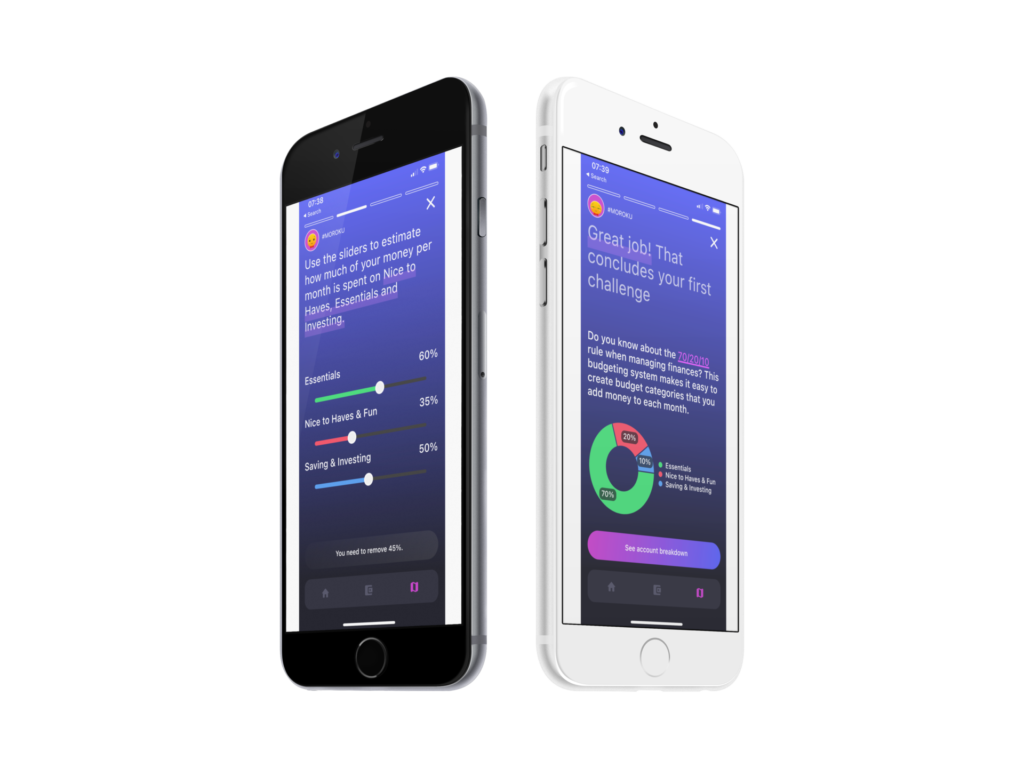

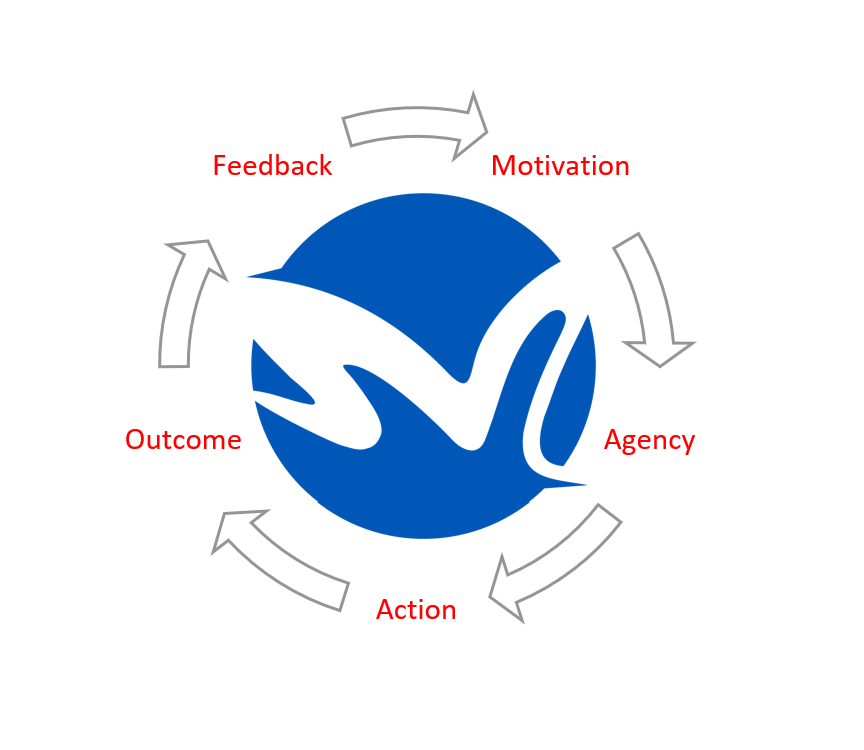

With this background the Odyssey Spending Challenge is organised around these three principles of engagement to ensure that the engagement loop integrity is maintained and that:

- There is a clear call to action

- Users are taken on a journey with challenges getting greater as their skill increases

- The paradox of choice is removed and simplified to core principles of money management.

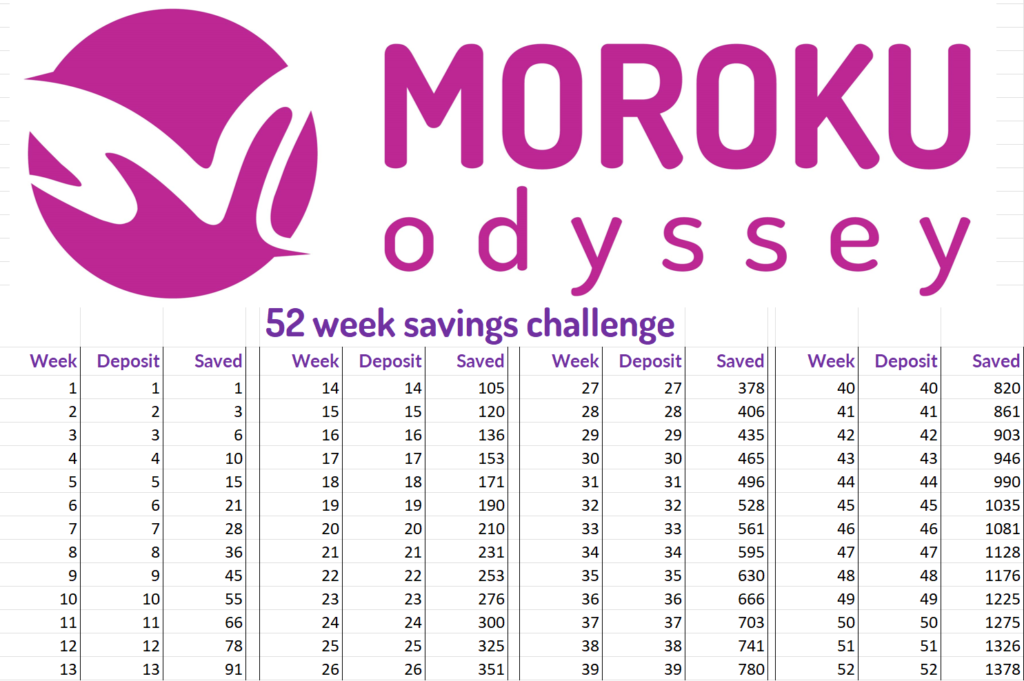

Budgeting and saving can be difficult and boring with more anxiety being created with the cost-of-living increases. For a number of years, Moroku has included a range of money challenges within Odyssey to solve these real problems within the digital banking experience. These include the 52-week saving challenge, the no spend challenge and more that are all capable of delivering thousands of dollars into your customers’ accounts and able to be turned on from within Odyssey.

These challenges then combine into money missions with levels increasing the size of the challenge along with the level of automation that runs the challeneg in the back ground for the customer as they simply set and forget, presented as they get better and stronger with their money.

Money missions are available within Odyssey for those banks and fintechs that have their own money management app and want to consume it as a service. It s also available within Money for those that want a whitelabel mobile banking app and Moroku to operate the customer experience.