With an unmet financing need of $5 trillion and approximately $1 trillion of annual revenue at stake for banks, SMEs provide a deep but complex pool of opportunity. Building digital offerings around a game architecture clarifies user leagues, missions, content and tooling.

Micro and small merchants drive economic and employment growth around the world , representing about 90% of businesses and more than 50% of employment. In most OECD countries, SMEs contribute more than 50% of GDP, and some global estimates put this figure as high as 70%.

SMEs fuel economic growth, create many new job opportunities, drive innovation and in recent years have registered a higher growth rate as compared to the global industrial sector. When big industries downsize, SMEs adapt, developing and create more jobs due to their greater ability and need to adapt.

Representing one-fifth of global banking revenues, SMEs generate around $850 billion of annual revenue for banks—a pool expected to grow by approximately 7 percent annually over the next seven years.

Despite being a rich pool of growth, they are severely underserved by the finance community with access to finance regularly cited as a key constraint to SME growth. Success is hampered by lack of access to capital, knowledge, holistic support and feedback as to where they are in their journey, how they are doing and where they could be doing better.

Banking solutions today are largely payments (terminals and fx), bank accounts, and lending. As indicated above, lending is the key revenue driver within banking and is severly hampered by lack of transparency and expertise in the evaluation of SME loans. Consequently SMEs suffer a financing gap, borrow on less favourable terms, for short duration and are therefore restricted to internal finance sources such as own savings, borrowing from friends and relatives and internal profits which puts a severe constraint on their capacity to grow and take advantage of market opportunities.

The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financing need of $5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending. East Asia And Pacific accounts for the largest share (46%) of the total global finance gap and is followed by Latin America and the Caribbean (23%) and Europe and Central Asia (15%).

Whilst SMEs have traditionally been very cash centric, adoption of mobile payments technology across the board is rapidly increasing the transparency of the SME economy as consumers and SMEs begin to realise the safety, convenience and efficiency of digital payments over cash. There is no doubt that the pandemic has accelerated digitisation and this process. This creates an opportunity to build out digital platforms that combine this data, behavioural profiling, mobile payments and business execution to engage SME merchants to build skills, run better businesses and in doing so build the transparency, insight and expertise in assisting them with finance and growth.

Personalisation

Whilst deepening and refining their digital offering is essential to service the SME market, service providers are heavily encouraged to personalise the experience based on the differences in growth phase, digital capability, financial literacy, business complexity, shape and relationship status across the SME customer base. This awareness needs to be built into digitization strategies, in a way such that the vast specturm of clients can be supported on their own journey.

Digital Hygiene

As these offerings are designed it is critical that the digital hygiene factors of client onboarding, quick and transparent credit decision-making, mobile first and low-cost, fast transactions are inherent. These are table stakes for mobile SME clients and play a fundamental role in retaining customers in an increasingly competitive financial world beiong offered by a bnraoder group of competitors

Unbundling Continues

As with other banking sectors, SME banking is being unbundled by fintechs, embedded finance providers and big tech expanding into financing. These providers are delivering offerings that help SMEs grow reduce costs, manage the ebbs and flows of cash flow, get money faster, spend less time on admin and more time on the things that matter – their core business activities and their lives. Offerings include traditional banking products and many other business services, such as invoice management, payroll support, tax preparation, and inventory management. Xero and MYOB have done well on the accounting front to lead with value and quickly enter payments. Grab is grwoing aggressively beyond its core business of ride sharing into an end to end play for their SME franchise holders . The company began as a ride-hailing service, then began offering food delivery services. The platform also provides embedded services such as payments, insurance, investments, loans and credit. This structure enables users to buy and access financial products while staying within Grab’s ecosystem. Judo has built a strong business for SME lending in Australia as Air Wallex has done for FX.

Journey by Game

Given the vast spectrum of clients the daunting task is in provisioning the right tools, including content and money systems to the right client at the right time whilst building up a deeper picture of insights along the way to fuel credit and risk decisioning.

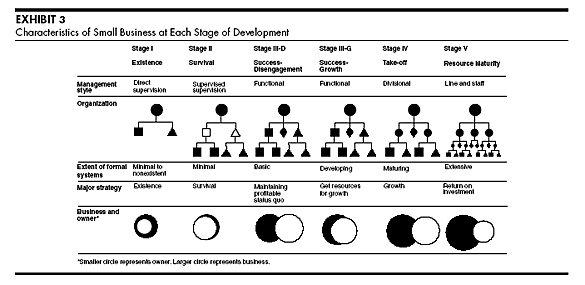

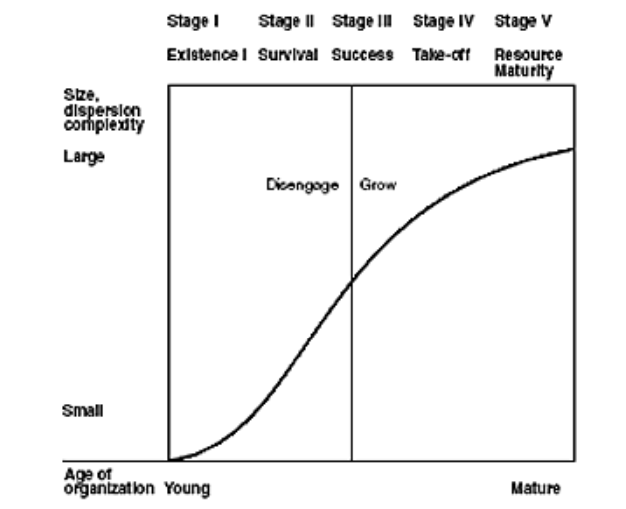

In 1983 the Harvard Business Review published a framework to assist with the edification of the nature, characteristics, and problems of businesses ranging from a corner dry cleaning establishment with two or three minimum-wage employees to a $20-million-a-year computer software company experiencing a 40% annual rate of growth. A number of stages were created, each characterized by an index of size, diversity, and complexity and described by five management factors.

Whilst nearly 40 years old, the model provides good insight and basis for SME customer journey design within a game context as it helps identify some of the challenges and skills that we may seek to build into the player missions .

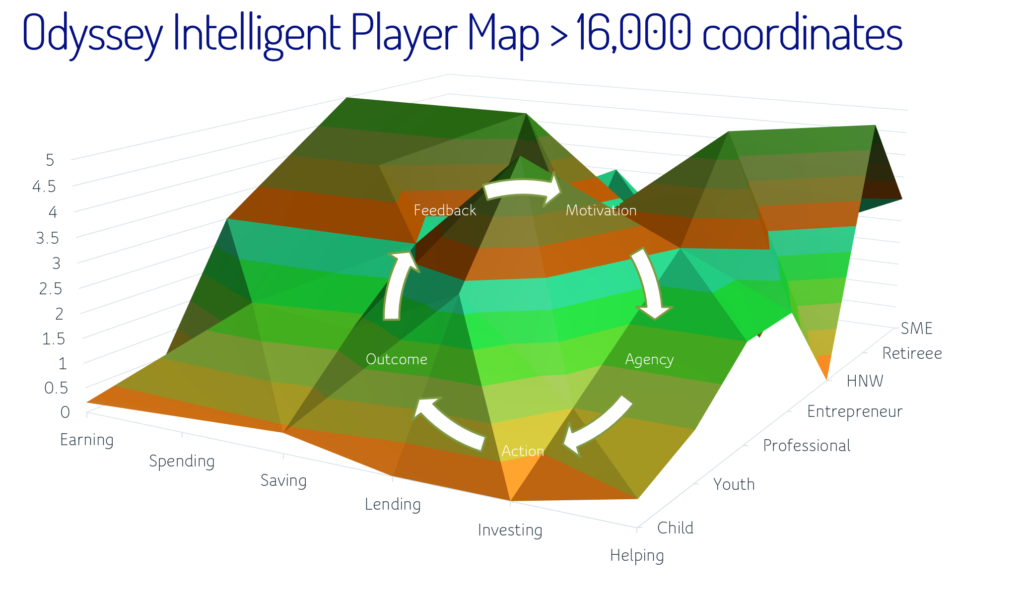

Odyssey is a journey of financial habits , discipline and skill building across multiple leagues and missions that are the major money systems of

Earning

Spending

Saving

Lending

Investing

Protecting

Helping

Moroku Odyssey is an orchestration and engagement platform for financial services companies. Operating from the cloud it integrates into financial service providers digital infrastructure to drive engagement and promote loyalty. Player maps determine where customers are on their journey then provides incentive, feedback and reward for their progress.

Game is a great model to drive engagement. When we treat customers as players, they are inherently engaged because they want to win and are rewarded and encouraged to do so. No other lens has this level of customer centricity.

Each of the above missions comprise a set of levels, each of which in turn are comprised of a set of challenges that are oriented around building financial skills, habits and discipline. These are most complicated in the SME league due to the increased complexities involved. It is these complexities however where there is opportunity to unlock value and guide the SME owner on their journey, unlocking tools, money subsystems and content as they go. Within the SME segmnet money susbsyetms can include a broad range of financing and payment capabiities , all sized for the postion of the player on the map. As they players get better at using these, they get in the flow and level up. Again the HBR framework is a useful guideline in the definition of these levels/stages.

Configuration of the missions, levels and challenges occurs during the On Ramp design process where customer segments are evaluated along with the objectives and win states for the customers and the client.