The Odyssey to Banking Sustainability

- All stakeholders are demanding more ESG action

- Customers want to meet their business and lifestyle needs whilst being socially and environmentally responsible

- Sustainability includes financial inclusion where there is much work to be done and opportunity to lead

- Embedding sustainability deep within the digital experience with data and game presents massive whitespace

We are facing extinctions on an almost unimaginable scale, similar to those that have only been documented a handful of times in billions of years of Earth history. We are going to find out how good we are as custodians.

The Bank of England has warned banks to take immediate action on climate risks or face a hit to annual profits. Regulators, customers, investors and special interest groups are all demanding more action on the impact of money on the planet. Indeed sustainability covers more than the planet. Income equality is threatening the way we view and act towards each other, as aspects of our societies regrade to days gone by, feudal systems where the haves and the have nots are separated by walls.

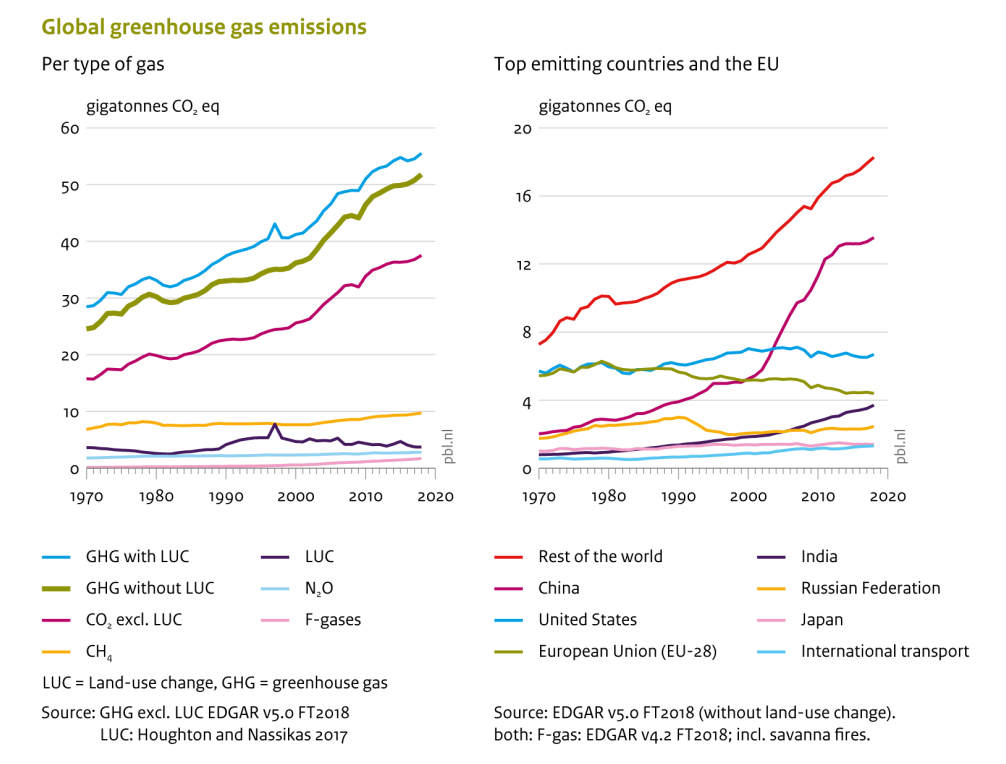

It is hard to argue that we are doing enough as our use and production of carbon continues to mount, as Britain’s leading energy economist, Professor Dieter Helm, pointedly articulates. How we eat, clothe and move is having a significant impact on our planet’s health.

With the growth of the Environmental, Social and Governance (ESG), customers are asking a lot of questions about their banks’ corporate policies. Is the bank transparent with its public disclosures?

Does the bank use its resources responsibly? Does it treat its customers and employees fairly? Does the bank fight corruption? Does the bank support environmentally sustainable customer money decisions? How is the bank using its capabilities to support financial inclusion, wealth distrubution and climate action? Are banks just interested in supporting the wealthy? Do we need new banks to look after other segments of society ? Banks are now stack ranked not only on their service to customers but also their ESG stance as with this Newsweek Ranking that asks and qualifies banks against such criteria and lists the who’s who and who is not, on the worlds list of sustainable banks.

Meanwhile on another ranking system, QS Rankings consistently place the Royal College of Art as the top art and design university in the world. Moroku was invited to participate in a series of design workshop at the college on sustainable banking as the industry faces up to its impact, responsibility and opportunity on ESG. What did we learn ?

At a time when climate change poses one of the biggest challenges for the nation and the globe, Vote Compass data shows an overwhelming number of us want more action. In Australia, almost 60 per cent of voters want “much more” cuts to emissions. 79 per cent support further action. Banks are responding. Commerzbank is rebranding its innovation unit and early-stage investment fund as part of a sharper focus on sustainability. The German lender says that customer demand in the B2B and B2C is growing above all, including digital, for sustainable offerings.

The research with the RCA shows us that people want to be able to meet their life needs whilst being socially responsible and protecting the planet. However, making sustainable decisions is tough and full of choice and confusion. Banks have a role to play, not only in making sustainable supply chain decisions but also in supporting day to day sustainable choices of their customers. Individually it can feel like its hard to have an impact, but collectively we can have a massive impact. To do so requires us to be brought together – data can do this and banks have the raw material.

Fossil CO2 emissions are the largest source of global GHG emissions, with a share of about 72%, followed by CH4 (19%), N2O (6%) and F-gases (3%). What we eat, wear and how we move has a massive impact. This data is in the banking and payments system. What is required is an engaging way of presenting it to consumers.

Apply for the Sustainabilty Design Sprint

Purchasing Decisions Impact The Planet

57% of these emissions are linked to our purchase decisions or about 12.7 tonnes of CO2 per person. To put that 12.7 onnes into perspective, it would be

- Your heating going full blast for 80 days straight (although it would explode before you got there).

- Driving 23,000 miles in the average car – that’s once around the world.

- Eating over 1,000 beef steaks or 4,100 camemberts.

If ‘miles driven’ or food isn’t helping you visualise 12.7 tonnes, how about the equivalent weight. It’s the same as:

- 18 dairy cows

- 10,500 bottles of wine

- 25 million plastic straws

73% of consumers globally said that they would definitely or probably change their consumption habits to reduce their impact on the environment. 52% of Aussies say they’d pay more for products or services if it came from a business that was actively reducing its carbon footprint. In a world striving for climate action, consumers are becoming increasingly aware of their purchase behaviour. There are gains to be had; shower gels saw sales decline 0.8% in 2018, whilst sales of natural shower gel sales skyrocketed upward 80%. We are voting with our wallets.

The RCA team reviewed market research from Deloitte, Visa and Mastercard to understand the current landscape of sustainable behaviours and augmented this with some primary research, interviewing consumers on the streets of London.

They concluded that young adults want to feel better about themselves through the decisions they make, caring for the planet and the next generation, by opting for a greener lifestyle in their everyday activities. Yet they lack they knowledge of how to live more sustainably, with uncertainty about how those decisions actually deliver an outcome and are conflicted with everyday priorities. They want to act and build habits oriented around their goals, by being able to understand the impact of their decisions and feel a sense of belonging when they do so. They want to know how the small decisions they are making are having an impact. Providing feedback on the sustainability of consumer purchasing decisions by adding sustainability intelligence into the payment infrastructure can do this.

“The consumer of 2122 doesn’t consider sustainability principles & guidance as nice to haves, or even competitive advantages. They’re table stakes, as important as security, privacy, & liquidity. The sooner markets respond to this opportunity, the better hope we have of an inhabitable planet for future generations” : Joel Hanna, CEO, Big Little Brush.

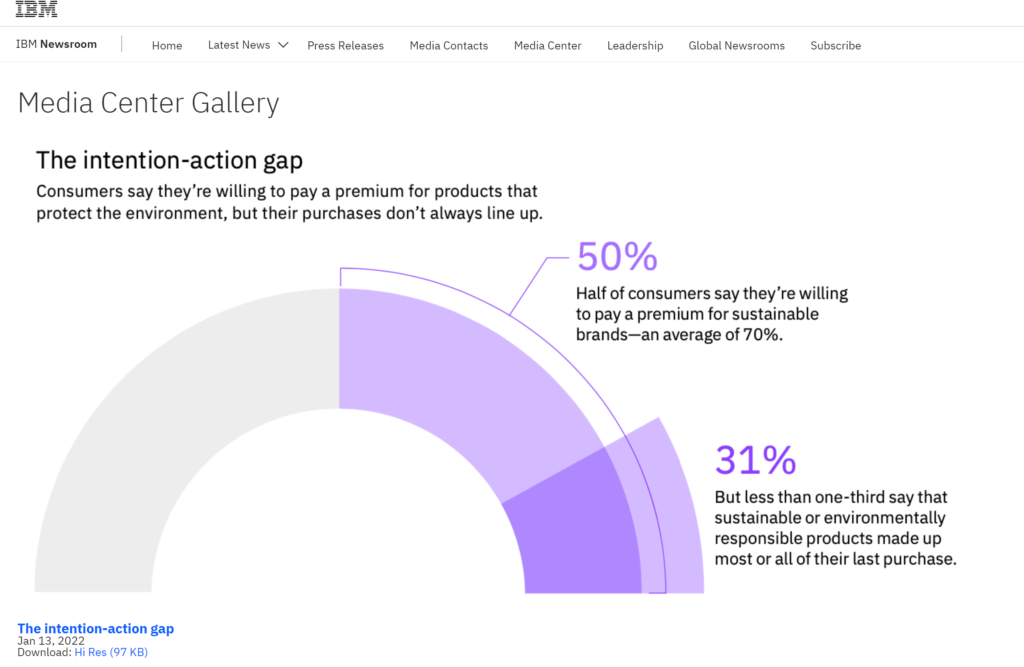

There is currently a lack of capability in the day-to-day transaction infrastructure that actually helps users towards adapting to action to help climate change. IBM call this the intention-action gap. There is a significant opportunity to leverage the need for social and community belonging and participation by using rewards and incentive theory to motivate consumers towards action and drive peer to peer engagement. This can be done by extending the transaction categorisation capabilities being used to help budgetting to calculate and show collective and individual impact on consumer purchasing decisions.

Beyond Carbon to Financial Wellbeing

Sustainability impact is not restricted to climate change, with ESG covering a broad set of objectives across environment, social and governance. The social pillar includes an organisation’s relationships with stakeholders and its impact on the communities in which it operates. This later factor is certainly an area where banks are equipped to have a massive positive impact. Numerous scholarly studies have highlighted the connection between financial wellness and overall wellbeing . Financial wellbeing is important for supporting general wellbeing in individuals and the broader community. Good financial wellbeing enables control over choices, strengthens resilience when things go wrong, supports participation in society, and builds confidence in the future. Lack of financial wellbeing impacts on physical and mental wellbeing, increases stress and anxiety, and limits the life opportunities available to people. Financial wellness is driving inequality across society. Building and supporting financial skills and strng habits is well within the wheelhouse of the industry, should it choose to find the balance within its business model to do so.

Financial wellbeing is when a person is able to meet expenses, has some money left over, is in control of their finances and feels financially secure, now and in the future.

For a longtime banks profitted when others have made mistakes or atleast failed to succeed. Mortgages are a classic example where, at a micro level, banks fail when customers pay off their mortgage as a stream of revenue drives up. Yet strategically making a bank a place where people can succeed paying off their loans makes a lot of strategic sense, as people are more encouraged to go to such a bank as well as making lots of ESG sense.

Helping the financially vulnerable is a significant commercial opportunity. While lower income groups and the financially vulnerable typically present banks with increase costs, risks and lower revenues, leading to a desire to off load or decline to bank them, inclusive practices align with long term success, with compelling strategies considering the potential financial gains and social impact. Understanding this segment, placing them within their own league on a player map, presents customers with much greater chances of success and resilience. As these customer succeed they will cost the bank less to serve, be increasingly more profitable and generate a strong social impact statement. Embedding content loops, reward, success based pricing and money system unlocks in their journey are all examples of how banking this group can be different and successful when placed within a game context. Other innovative ideas include allowing wealthier customers to participate in the resilience building of the lower income groups through basis point contribution schemes. A 10 basis point reduction in savings interest may not seem much to someone wealthy, but the quantity may have a significant impact on someone trying to pay their energy bill. Leveraging game mechanics such as ulturism and collarboration can be leveraged for action in a game based context.

Thinking holistically about ESG, mapping spending and saving data across financial wellness and sustainability journeys presents a lot of win:win opportunity. Customers win by building financial and planetary resilience through their behaviours. By revealing this within the experience, banks get to win by building better customers and communities.

Whilst Robinhood demonstrated the bad of embedding game elements within digital financial experiences there is much more positive that can be done with by thinking about the challenges customers have, the skills and habits we want them to establish. Using Moroku On-Ramp and Odyssey are great ways of doing this.

Whether its spending or borrowing, there are many great places to embed sustainability goals, missions, actions, nudges and rewards within the banking experience in ways that support sustainability and growth. Data presented within a player map and surfaced via thebanking app, shows everyone how they are doing individually as well as collectively; Tuning our everyday purchasing decisions in support of the planet could be a thing of beauty.

Banks, like Bank Australia are beginning to get it. A sustainable payments infrastructure is more than using green data centers. A banking and payments infrastructure that promotes sustainable purchase decisions and financial wellness can have a massive impact and be a huge growth lever for banks that align strategically. Purchasing decisions can be linked to alternatives to drive engagement, loyalty, trust and hope.

Odyssey is Moroku’s configurable, multi-league, engagement engine for financial service providers that want their customers to succeed and can be used for this purpose. Odyssey knows where customers are on their journey and where they’ve come from to then nudge them onwards. The platform allows banks and FinTechs to deliver personalised digital financial journeys to help customers win with their money, unlocking new weapons, skills and allies on the way. The platform has a set of player maps for the core banking activities of saving, spending, lending and investing and operates across demographics and life stages to begin the process of personalising the journeys. As with financial wellness, this approach is adaptive to planetary wellness.

Banks and FinTechs with large enough data sets can lift them onto platforms such as Odyssey to provide customers with guidance not only on how they are doing financially but also on how their are journeying on sustainability. This feedback is provided as an individual as well as a collective. By embedding such strategic engagement initiatives into the digital experience financial institutions are able to build empathy, support and encouragement for the hard work customers do. Ultimately this builds relationships and loyalty.

There’s plenty of fun to be had along the way to sustainability. Americans produce 25 percent more waste than usual between Thanksgiving and New Year’s Day, sending an additional one million tons a week to landfills. This could be a perfect time to run a focussed mission on how buying stuff impacts the planet and have some fun.

We are vast network of connected beings, working together, capable of restoring balance. As we wait for governments and world leaders to lead our way forward, individuals are increasingly ready to activate collectively. We should dare to provide them the platforms and incentives, based on human psychology, involving not logic, but aspects such as fear, greed, laziness, and narcissism on the one hand and hope, faith, struggle and success on the other to guide and support customers to do the right thing and participate.