Odyssey journey to AI

The journey to hyper personalisation.

Artificial Intelligence presents enormous opportunity to explore the world, identify patterns within it and place robots at the front line to do boring, complex or dangerous work. AI works by harvesting large amounts of data, evaluating patterns to be described using maths and pointing it in the direction of good. At Moroku we think that good involves using AI to help people thrive with their money.

Artifical Intelligence’s accuracy and usefullness is dependent on three factors:

- The data sets upon which it is based,

- The depth and learning ability of the algorithms

- The purpose and bias with which it is directed.

The first factor is foundational . Moroku CEO, Colin Weir, learnt this during his first attempt at building algorithms in the 1980s, during his post graduate research. The heart of his thesis was the development of a mathematical model to determine the economic impact of management decisions on the plantation forests of New Zealand. Past knowledge suggested that yield curves had a shape which was sigmoidal and could be described by a yield equation, with various coefficients describing the impact of yield (Y) over time (T). As more data was collected and coefficients analysed a new parameter, competitive index was found to greatly improve the accuracy of the predicitions.

During the 1980s research was conducted manually, adding and testing the utility of parameters. The key power of AI is to continue to add and test parameters to the algorithms as it learns the connection between inputs and outputs, such as with competitive index and yield. By adding and testing additional parameters, AI is able to create algorithms at speed that self adapt to fit data distributions.

One set of AI tools of particular relevance are large language models, or LLMs. These are deep learning algorithms that can recognize, summarize, translate, predict and generate text and other content based on knowledge gained from analysing massive datasets. Anywhere language is used, LLMs are useful: Translation, chatbots, search engines, composition of poems, songs and stories, writing software or moleculular and protein structures for new vaccines or treatments. Financial advisors can use them to describe financial markets, banks can use them for anomoly and fraud detection, legal teams can use them for paraphrasing and scribing.

Large data sets are largely fed into an algorithm using unsupervised learning, i.e. without explicit instructions on what to do with it. The model learns words, the relationships between and the concepts behind them. This knowledge can be used to predict and generate content.

Moroku Odyssey creates the initial algorithm sets to prime the large language models (LLMs), around a telos of engaging and personalized financial wellness experiences. By integrating game mechanics into the engineering process, Moroku Odyssey primes LLMs to understand and respond to users’ financial behaviors and needs effectively, redcuing costs, increasing speed and the direction of the models.

How It Works:

Data Integration

Moroku Odyssey collects and integrates financial data from various sources, providing a comprehensive view of users’ financial health.

Initial Model Set

Odyssey players maps provide a multi dimensional 16,000 + coordinate model by way of a set of algorithms, oriented around customer success, that consume the data, convert it into a set of nudges taht are then fed, event driven, into the customer experience

Personalised Insights

LLMs analyse the response of the customers to generate increasingly personalised insights and recommendations, helping users make informed financial decisions.

Engagement Through Gamification

By embedding game mechanics, Moroku Odyssey keeps users engaged and motivated to improve their financial wellness.

Continuous Learning

LLMs continuously learn from user interactions, refining their recommendations and improving the overall user experience.

Benefits

Enhanced User Engagement

Gamification and personalized insights keep users actively involved in managing their finances.

Improved Financial Literacy

Users receive tailored advice and educational content, helping them understand and manage their finances better.

Better Financial Outcomes

Personalized recommendations and insights lead to more informed financial decisions, improving users’ financial health.

Increased Customer Satisfaction

Engaging and helpful financial tools enhance overall customer satisfaction and loyalty.

By leveraging LLMs and gamification, Moroku Odyssey provides a unique and effective approach to promoting financial wellness

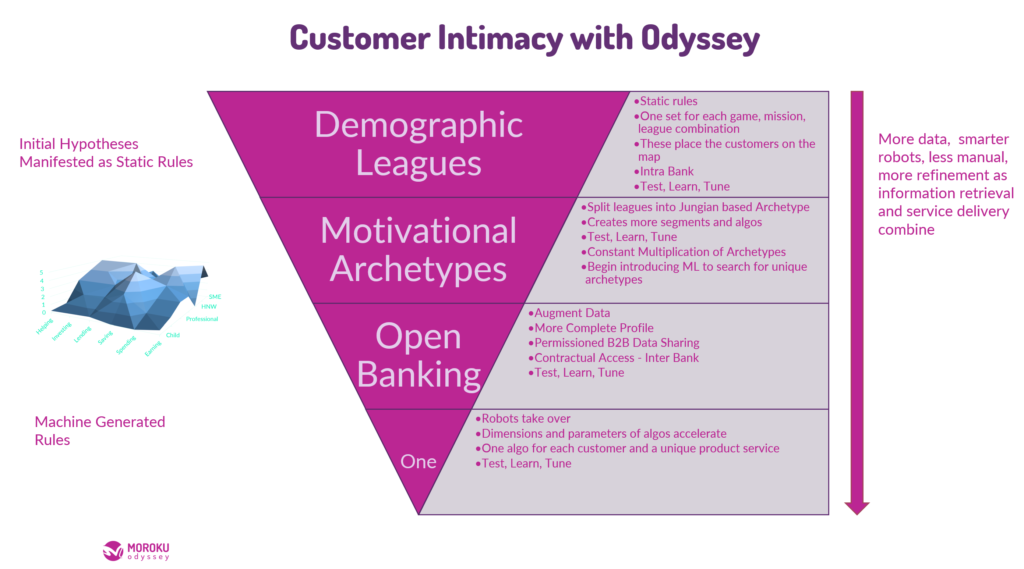

AI has a lot to offer financial services, Moroku’s mission, the hyper-personalisation of customer financial journeys and the tailoring of unique digital products and services. As with the forestry example earlier, we begin with an initial cut of the algorithms, spread across a representative group of player leagues. These place the customer on the map and exist within the context of an individual bank or client of Moroku. Through a series of increments, more data is added through psychological archetyping and open banking to grow the data set, increase the granularity of the algorithms and the pattern exploration. Eventually the deep learning takes over the algorithm generation as players have algorithms refined just for them.

This is how we define hyper personalisation, using AI, in the context of financial services.

At the heart of this journey towards a hyper personalised experience is the requirement for empathy, to go beyond logic, reason and patterns to unlock feelings and emotions. This remains a challenge for AI . We know we act based not on what we think but on how we feel. To improve its utility, AI must go beyond trawling the internet for previously defined or provided answers, to searching the very many answers available on the internet, synthesise their behaviours into a range of view points, qualify them as to their factual evidence, over lay them with some perspectives of the unknown and then apply the human factor. For those looking to ChapGPT to complete their exams, apply for a job, respond to a RFI or RFP, there remains a long way to go. For those looking to create connection there looks even further to go.

AI is amazing. Beyond stripping cost out of customer service and creating funky pictures there is real potential to help customers thrive in the new digital world.