Digital bank

Case Study: Volt Bank Builds a Differentiated Digital Experience with Moroku

Challenge: Competing in a Market Dominated by the Big Four

As Australia’s first neobank to receive a full banking license, Volt Bank entered a market long dominated by the Big Four. To succeed, Volt needed more than just a digital interface—it needed a differentiated customer experience that could:

✅ Drive customer engagement

✅ Deliver economic efficiency

✅ Enable organizational agility

Volt’s leadership recognised that traditional banking models wouldn’t cut it. They needed a platform and process that could help them stand out, scale fast, and connect deeply with customers.

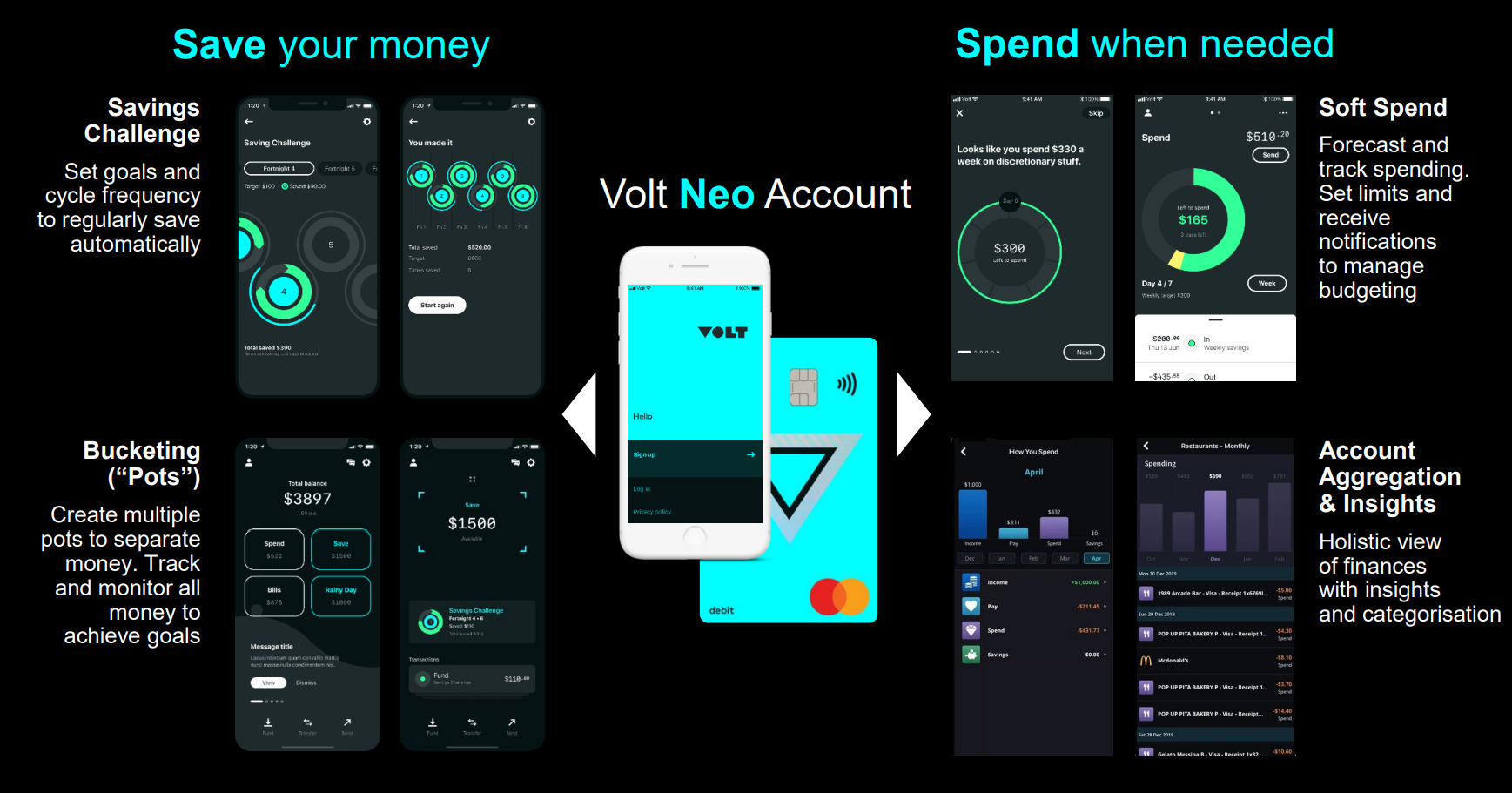

Solution: A Gamified, Mission-Driven Platform for Digital Banking

Volt partnered with Moroku to design and deliver a next-generation digital banking experience using:

1. Moroku On-Ramp: Strategic Experience Design

Through the On-Ramp process, Moroku helped Volt:

- Define a customer-centric mission focused on financial empowerment.

- Design a gamified experience that rewarded positive financial behaviors.

- Align product development with user journeys and emotional engagement.

2. Moroku Odyssey: Platform for Engagement and Agility

Volt implemented Moroku Odyssey to:

- Deliver a mission-based digital experience that guided users from financial novice to expert.

- Use real-time data and behavioral triggers to personalise engagement.

- Enable rapid iteration and deployment of new features, supporting Volt’s agile operating model.

Results: A Digital Bank Built for the Engagement Economy

With Moroku’s support, Volt launched a platform that was:

🎮 Fun, intuitive, and rewarding—turning banking into a journey, not a chore

⚙️ Built on a modern, scalable architecture—ready for rapid growth

💡 Designed for differentiation—offering a unique value proposition in a crowded market

Volt’s experience demonstrated that engagement is the new competitive advantage in digital banking.

Conclusion: Winning with Experience, Not Just Infrastructure

This case shows how Moroku Odyssey and On-Ramp can help digital banks:

- Compete with incumbents through experience innovation

- Build agile, scalable platforms that evolve with customer needs

- Deliver measurable engagement and economic outcomes

🔗 Learn more:

Digital banking

Digital Banking requires Experience

When Volt Bank wanted to get to market they need a technology partner who understood contemporary technologies as well as how to build teams.

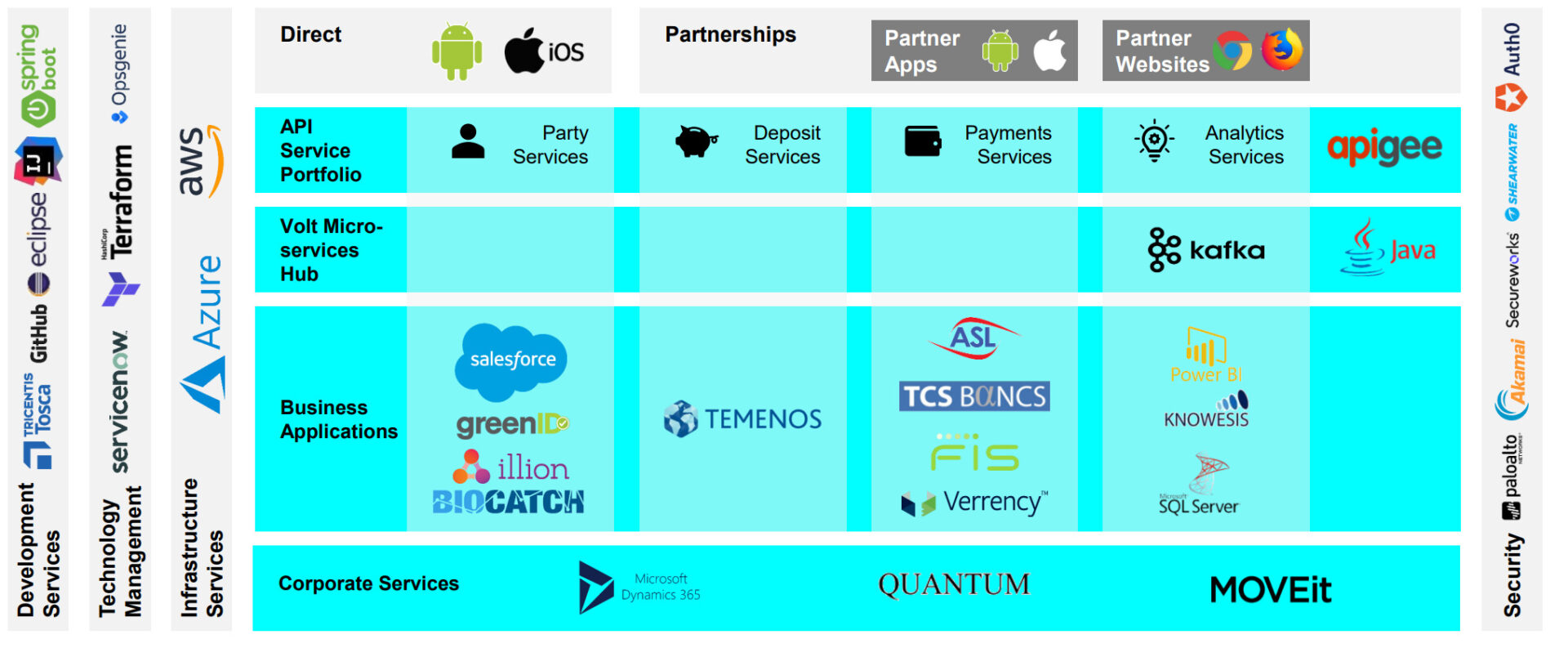

Mobile Application Development

There is more to building a mobile app than app development skills. Getting to market requires application development processes that manage requirements and incorporate CI/CD automation via one team for less managing, more doing and clear ownership across application services and infrastructure.

Moroku brought a focus on automation, infrastructure as code, monitoring, alerting and production readiness to get Volt into production within 90 days of arriving and then establishing a constant delivery capability.

An end to End Architecture

Building a digital infrastructure requires multiple components from digital channels, business applications, core banking and payments services and infrastructure services. Moroku brought these together in a unified way for core stability, ensuring application and platform events were managed in a single place, with alarms and communication channels in play to ensure issues were visible and services connected.