A digital banking strategy realises that banking is moving to a networked/decentralised, component based, manufacturing and delivery model. Multiple analogies to motor vehicle manufacturing have been used and for very good reason. The more you can define commodity, platform components that multiple products and brands use, the more agile and flexible you become, tehmore chopcies and less locked in you are and the more focus on the customer you unleash. Volkswagen led a paradigm shift from product-orientation to production and process orientation. VW’s production network makes a significant contribution to the value of the company as a comparison with its competitors shows. Volkswagen has turned production from a cost driver into a success factor.

In the automotive industry it is easy to make a very costly mistakes by betting money on something that does not sell. Such mistakes are extremely expensive: factories and tooling cost hundreds of millions of dollars. At the centre of the problem is that demand for existing cars is quite hard to predict, and demand for new cars all but unpredictable as has been very evident in the transformation to EV. Volkswagen mitigates this problem by focussing engineering efforts on using the same basic parts across multiple cars, even cars of different brands. This strategy is known variously as “component commonality”. Moroku calls it “toolkit strategy” or “platform sharing”. Demand for individual components is quite stable because risks associated with demand for any one car are mitigated by pooling them together. Predicting aggregate demand for a few components is easier.

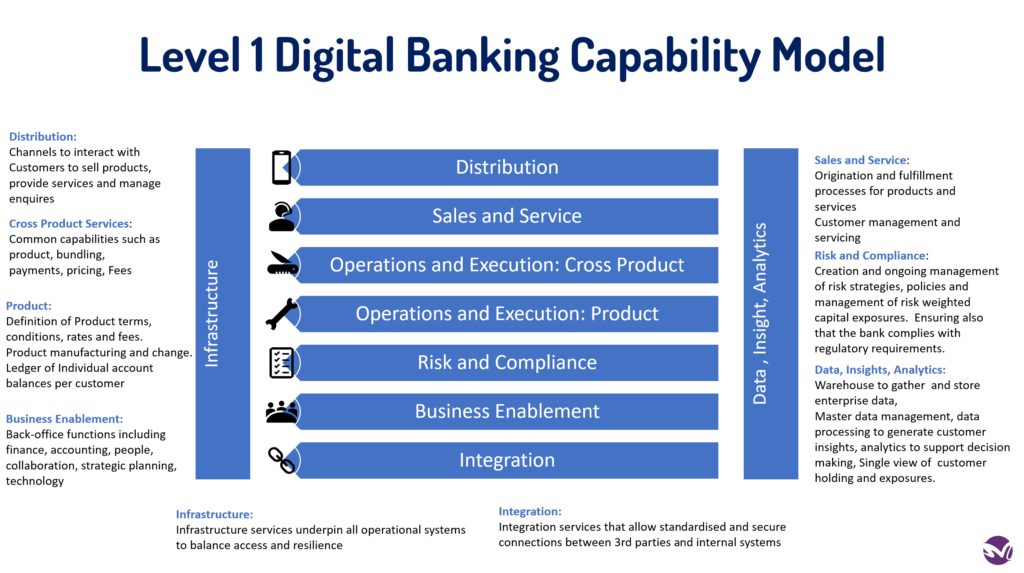

Deliverying digital banking is well construed via a platform sharing model. By breaking down the bank into its various capabilities:

– All capabilities are defined so that none are forgotten about

– Teams can be set apart and released to work

– Capabilities can be swapped in and out

– An IT strategy of software and systems can be created that delivers agility

Banking is a manufacturing and distribution business, not unlike making cars. Uber pulls no punches when it shows the way forward as the competition and ecosystem continue to broaden and intensify. Uber led with an embedded payments business model in a two sided marketplace. It quickly identified SME banking opportunities for their underserved drivers “need a loan for that car?” Uber showed us that once you define the service component, e.g. loan, you can isolate it and determine at any time, what is the most fit for the job given the potentially competing priorities of the customer and the business and how to respond in that moment in time.

As banking is “utilitied” it will be commoditised and scaled or “tribalised and boutiquified”. Customers will look for price or value. As they do they will continue to have multiple banking relationships, necessitating multiple integration points. Risk management will be a competitive advantage when organised around the customer: the more granular and real time the better. Marketplaces will appear on the network, through the APIs , where banks operate as suppliers and customers at the same time. In this world, Integration is everything. “Everything as a Service”

Data and integration are accelerating us through a time of digitisation. As with VW’s toolkit strategy, we are broadening our integration services to the bank side with the Moroku Money Digital Services Layer. To date, this integration strategy has been focussed on exposing business services. With the Money DSL, Moroku provides a platform that allows banks to connect to Moroku and other service providers on the other side of the fence.

Our approach to digital banking begins with the evaluation of nine levels of capability, at increasing level of detail to isolate service components, determine fit for purpose, decide, and integrate. Integration (DSL) and Infrastructure sit at the bottom because they hold everything together. Distribution sits at the top because value starts with the customer.

The Moroku Capability Model is available as a consulting exercise for banks and fintechs who are looking to review what they need to build and move towards a componentised digital service offering. The capability levels enable the component mpodel to be architected, capabilities decoupled and the organisation unleashed from the shackles of legacy, monolthic manufacturing.